Having spent many years in compensation, one consistent pattern we continue to see is the prevalence of 3% as the annual aging factor in the United States (US). This raises the question: What factors influence this number, and is 3% still relevant in today’s market?

What does it mean to "Age Data"?

Because compensation survey data provides a snapshot of a specific point in time, surveys conducted at different times of the year will have different effective dates. This raises two potential concerns for comp pros:

- With how quickly the market moves, the data may feel outdated by the time it is actually applied.

- Because many teams rely on multiple surveys to inform their decisions, comp pros need a way to normalize the effective dates and level the playing field for accurate comparisons.

Aging data is the process of aligning survey results collected at different times to a common reference point. This is done by adjusting the market data using an estimated percentage that reflects how much you expect the salary to change over time. By aging the data, comp pros can get a more accurate reflection of the current or future market conditions and help their companies be more competitive.

Let’s walk through an example. You have 2 different surveys: Survey A has an effective date of January 1, 20XX and Survey B has an effective date of March 1, 20XX. You want to “age” these data sets to the new date of November 1, 20XX.

Table A below shows the calculations and steps needed to appropriately age the data from both surveys.

TABLE A. Formulas and Example Calculation of Aging Data

What is the Aging Factor?

When discussing the aging factor, you will likely encounter the terms “survey aging factor” and “annual aging factor”. Both are integral components of the same formula:

Figure 1. Aging Factor Formula

The annual aging factor (also known as annual market movement) is the percentage used to age the data. It represents an estimate the company makes about how much wage movement is happening in the given period of time. It is highly subjective and is influenced by internal variables, such as budget, and external variables, such as inflation.

The survey aging factor is directly impacted by both the annual aging factor and the specific target date to which the data is adjusted. This factor reflects your decision on how you want to align with current market trends.

The Science of Determining the Annual Aging Factor (aka Annual Market Movement)

The ASEAN Total Rewards Institute shares 2 ways to calculate this:

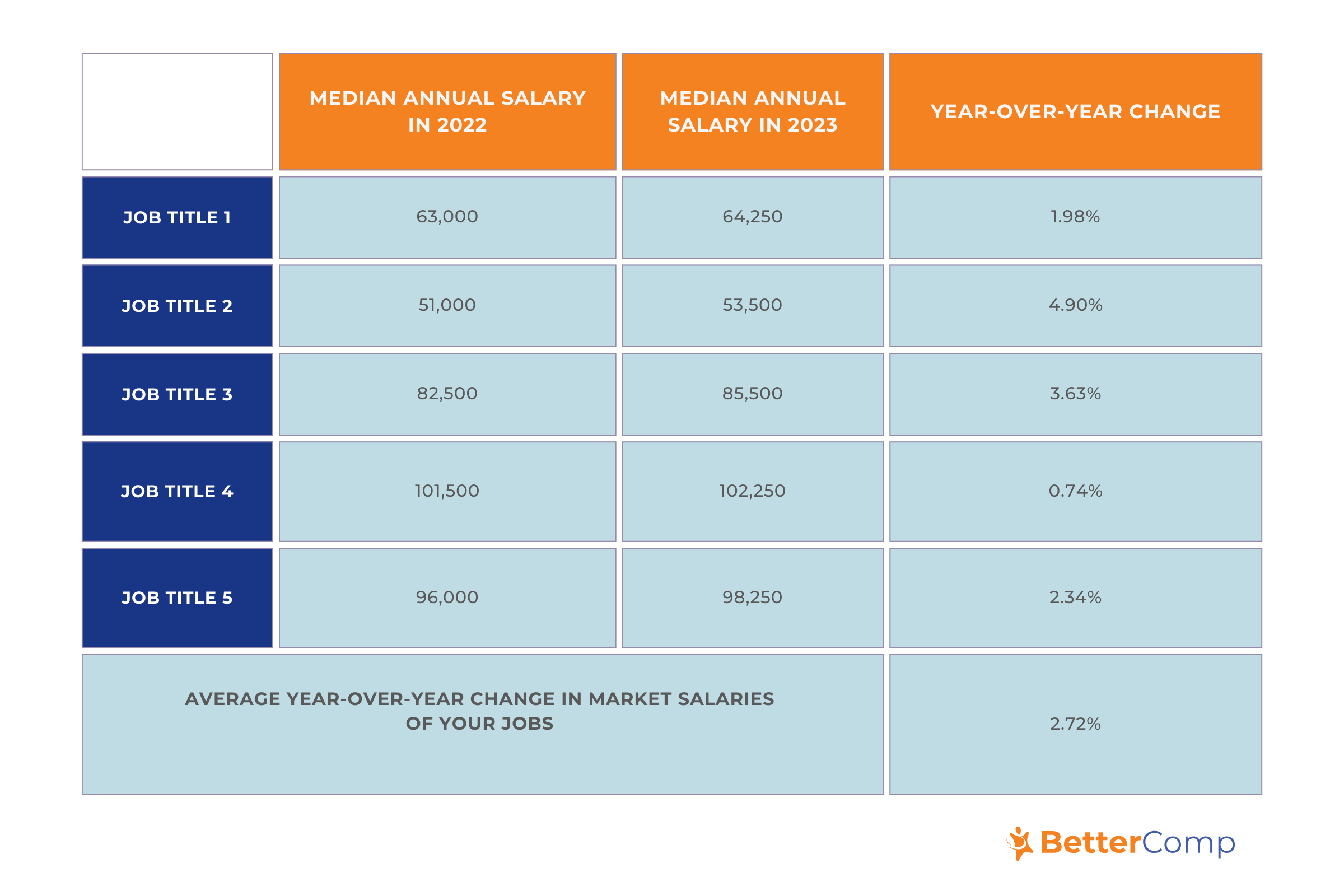

1. Determine the average year-over-year change in market salaries of all the jobs you’ve matched to, as in Table B below.

Table B. Example Calculation of Annual Market Movement

2. Calculate for 60-70% of the merit or salary budget trend.

For example, if the report states companies in the US are budgeting for a 5% merit increase, your annual market movement will be around 60-70% of that or 3-3.5%.

The Art of Determining the Annual Aging Factor

Once you’ve landed on a number using one of the methods above, your work is not done! Especially in a market that moves as rapidly as today, you will need to consider the external and internal factors that can influence your organization’s specific aging factor. And this is where the art comes into play.

The External Variables

Inflation is when the prices of goods and services simultaneously increase over time, decreasing the purchasing power of your money. It is felt by employees and employers alike and significantly influences the conversation around pay.

In reality, salaries often do not increase at the same rate as inflation or the cost of living. For example, the average home price in 1980 was $47,200 and in Q1 of 2024, it was $420,800, which is a 791% increase. On the other hand, the average wage has only gone up by about half of that (at 373% from $12,513 in 1980 to $59,228 in Q1 of 2024).

Regardless, inflation is still an important consideration for companies prioritizing employee engagement and attracting top talent. For global organizations, this includes keeping tabs on the economic trends of the different countries. For example, in 2023, the CPI reported an average annual inflation rate of 3.4% in the United States, while Argentina reported 211.4% (the highest in 32 years).

Because of this potential for drastic global economic differences, many companies will use different aging factors for each country. Organizations that cannot account for these differences financially may need to consider other parts of the total rewards program they can invest in, or at the very least, be prepared to communicate this decision with their employees.

Cost of labor is defined as “the sum of all wages paid to employees”. It is one of the most important external factors to consider when determining the annual aging factor. Essentially, the higher the cost of labor, the more employers are expected to pay to attract and retain top talent. This can vary greatly depending on industry, location, or job category (eg. Officer, Exempt, Non-Exempt, and Union employees).

Comp pros should pay close attention to the cost of labor when determining the aging factor because it’s all about how much employers anticipate the wages to change. However, the cost of labor typically will not be a direct reflection of your annual aging factor. This is because your annual aging factor will be influenced by several additional factors such as your compensation philosophy, strategy, and budget constraints.

You can find more information about the cost of labor by accessing the Employment Cost Index (ECI) or by checking with your survey provider to see if they report this data.

The Internal Variables

Your compensation philosophy is your company’s roadmap and guiding principles for paying employees. Part of this is your decision to adopt a lead, lag, or lead-lag strategy for your salary structure. The date you decide to age the data to will reflect this and will have a direct impact on your survey aging factor.

Figure 2. Aging Factor Formula: Determining the Number of Months to Age the Data

Figure 2. Aging Factor Formula: Determining the Number of Months to Age the Data

When you age your data to a specific time of the year, your ranges will lead the market until that time and then will lag after that time.

Once you’ve done the market analysis and landed on a starting number for your aging factor, it’s essential to conduct a budget analysis.

A good time to do this is while you are modeling your ranges. During this process, you can test out different aging factors and hypotheses to better understand the financial implications. This will help you determine if the aging factor you landed on is realistic for your company’s financial goals.

With BetterComp, you can model ranges at scale and create unlimited models to test out all your “what-ifs” and feel confident in your overall decision.

Selecting a Lead/Lag Strategy

Leading the market may make you more competitive, but at the same time, put you at a greater financial risk. Lagging the market may make hiring more challenging and increase turnover risk. It’s not very common for companies to lag the market for the majority of the year. However, it may be a feasible strategy for some companies looking to supplement with other motivators like excellent benefits. Mercer explains that many companies will use a lead-lag strategy and age the data towards the middle of the year as a compromise.

Figure 3. Impact of the Chosen Date on Your Lead/Lag Strategy

Finding that balance will depend on the stage of your company’s financial health, growth potential, company culture, and employer brand. Having a compensation philosophy in place can be the grounding force that guides you and helps you stay aligned with organizational goals, even in rapidly shifting markets.

Frequently Asked Questions

When aging data, you should avoid using data over 2 years old (some experts might even say 1 year). Beyond this, it’s best practice to get new survey data.

At least once a year, but you may need to do this more frequently, depending on how fluid the market is. Many comp teams will determine aging factors when they get new survey results and need to do a plan update. But really, you can review this anytime during the year.

In the US, there is the Bureau of Labor Statistics. In Canada there is Statistics Canada. Many countries have their equivalent websites that house their current and historical CPI, PPI, unemployment, and other key indicators.

The answer is, “It depends!” Instead of automatically defaulting to a certain number, we recommend you consider the external and internal factors discussed above (especially if you have employees in different countries). This will help you land on a number that makes the most sense for your company’s budget and brand while aligning with market changes.

Learn about creating a competitive compensation strategy that moves past lead/lag/match on the BetterComp Blog!

COMMENTS